On a balance sheet or income statement, sundry income might be listed as miscellaneous income. This income must be recorded on financial statements as it affects a business’s net worth and needs to be reported to shareholders. The two main criteria attributed to ‘sundry’, or ‘miscellaneous expenses’, are that firstly the value of the expense is minimal, and secondly the expense type is rare in occurrence. Should an expense be for a greater value, be incurred on a regular basis, or not be easily classed as miscellaneous in nature, the expense must be assigned to a specific cost code within the businesses’ accounts. Whilst smaller, infrequent, expenditure incurred such as office flowers, or a one-off bank charge for instance, would fit the definition of sundry.

The income must be reported to the Internal Revenue Service along with the income generated from normal business operations. By tracking the accounts payable, you are using the credit facilities at zero interest rates and paying the due amounts later. If payments are followed systematically, you can enjoy such credit facilities fearlessly. That is why it is essential to clearly state the credit period offered or the due date of payment in your invoices.

Size, industry practice & nature of an expense plays an important role to determine whether it should be included in sundries or be given a separate ledger account. T Shoes incurs many expenses that easily fit into categories like employee wages, rent, loss on product defects, and the list goes on. Let’s say they receive a shipment of 100 shoeboxes, but two of those boxes don’t have size stickers on them. The cost incurred to buy individual stickers for those two boxes would be written off as a sundry expense. That’s because this is not a normal occurrence, the amount expensed was very low, and the expense wouldn’t fall into a standard category like wages or rent.

Phrases Containing sundry

Hence it is a liability to your business until you pay for goods or services sold to you. Besides Sundry Income, there are Sundry expenses as well, which need to be accounted for in accounting. I suspect that the term sundry was more common when bookkeeping was done manually.

The part of a company’s accounts used for recording payments made by or to companies that are not regular customers, suppliers, etc. Whenever goods or services are availed on a credit basis from your vendors, it is important to specify after a discussion on the agreed-upon timeline for payments. Prompt payments can avoid poor market relationships as well as help you maintain a healthy cash flow. Customers of companies who rarely shop with credit and have a small purchase price are sent Sundry invoices. Historically when accounting was done manually, it was tedious for accountants to add pages of all customers, even with a small number of transactions, which made bookkeeping quite awkward.

- Many programs list them under “miscellaneous expenses” rather than sundries.

- You can specify a credit period of say 30 days in the party ledger for the party to make the payments.

- The need for sundry invoices has been significantly reduced in the age of accounting software.

- Stick with your same invoice template and continue with the next invoice number in your sequence.

These royalties would be included in sundry accounts because the business did not directly produce or service the people or accounts that produced the income. All accounts payable are liabilities of your firm and recorded as such. Examples of sundry invoices expenses include payable delinquent interest, gifts for employees, a party for the staff, etc. Before any company can create sundry invoices for debtors, it needs to establish who the customers/suppliers/or debtors are before sending out the invoice to them.

The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. Khatabook is one such accounting app that has numerous helpful features.

Meet FreeAgent

Since sundry creditors are a liability to a firm, they will be shown on the right side of the balance sheet. Businesses use a separate category to track these transactions and they are called sundry creditor accounts or accounts payable. In those days, bookkeepers had to add a page to the company’s ledger for each customer.

Now S Enterprises is reflected under sundry creditors and is entered in the accounts payable ledger of Gunjan Traders from the date of delivery of goods till the date S Enterprises clears the amount payable to it. Creditors are individuals or companies to whom you owe money for goods or services purchased on credit. The word “Sundry” is used for items which are irregular and insignificant to be listed individually. Sundry expenses are costs incurred during business operations that are not listed separately because they are usually small, rare, and do not relate to other general expenditures. This could be a company’s payment of their own expenses or a payment received for a sundry invoice.

He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Join our mailing list to receive free bookkeeping and tax tips, news and offers from FreeAgent . The Spectator, from 1981 to 2009, and on sundry topics until 2001 for the British tabloid The Daily Mail. There are several artist managers, tour managers, and sundry booking agents on hand, just to add color and contrast to the cheerleaders.

Word History

This doesn’t fall into a standard income category and is therefore labeled as miscellaneous income. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is what is sundries in accounting a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses.

How to Record it in the Financial Statements

In the above case, Daniel Constructions is a creditor for Axis Housing, and the same is recorded in their books for 90,000 due to the credit purchase. Suppose “Daniel Constructions” sold building material worth 90,000 to “Axis Housing” on credit and Daniel Constructions agrees to receive a delayed payment in the future accounting period for the related invoice. Its purpose is to club together all irregular, infrequent, and random nature expenses that can’t be classified under any regular business expense head. The company incurs various expenses like Raw materials, Rent, Advertising Costs, etc., which are regular expenses in its day-to-day operations. In one of the recently shipped orders of 1000 customized shoes for its client XYZ International, it was found at the time of delivery that an individual logo was not pasted on 200 customized shoes.

When you buy certain goods/services from your vendors or suppliers, you must ensure that you discuss and agree on a specific timeline to make your payments. Especially when you purchase goods on credit, it is important that both parties have agreed on the payment timeline, so that there isn’t any bad blood at later stages of the transaction. Sundry creditors are considered as liabilities to a business as they are supposed to pay outstanding amount, for a specific transaction, based on the agreed timeline by both the parties. An online accounting and invoicing application, Deskera Books is designed to make your life easier.

Sundry income is often irregular and not a guaranteed source of company income over the long term. They can be related to a particular area within a business such as sundry office expenses, sundry retail expenses, etc. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless.

It is significantly useful in managing ledgers and generating business reports. Therefore, a business can be handled in a feasible manner with this app. If you purchase goods or services on credit from your vendors, you will need to track and record the transaction and amount due to your suppliers. This means a business owes them money because of credit facilities on goods and services they have availed.

Stick with your same invoice template and continue with the next invoice number in your sequence. If you’re a business owner dealing with foreign currencies, include the exchange rate on such an invoice. Also include payment terms, typically 30 days, but almost certainly less than three months. Feel free to add comments if it will increase clarity on sundry invoice costs.

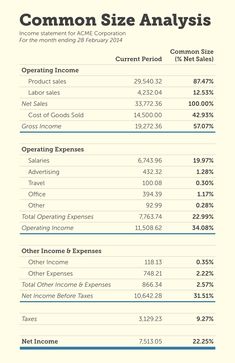

A business might elect to combine several minor expense accounts and report them in aggregate in a Sundry Expenses line item. This is especially likely when a firm has a large number of line items on its income statement, and needs to condense the presentation. However, if these expenses become regular and include larger amounts, they will no longer qualify as sundry. Instead, they will need to be reported separately with a precise description in the balance sheet. Sundry expenses are shown on the expenses side of a profit and loss account .

Suppose a furniture-making company, Wood Ltd. sells furniture worth 30,000 to QRT Ltd. on credit. Financial statements are written records that convey the business activities and the financial performance of a company. Comprehensive income is the change in a company’s net assets from non-owner sources.

If a page were added for every customer, even occasional customers with small transactions, the books would become cumbersome. So, bookkeepers added one page called sundry where those customers could be recorded. The need for sundry invoices has been significantly reduced in the age of accounting software. The dynamic accounts payable head is significant to your business’s health. When the debtor who owes the firm money doesn’t pay on time, it may disrupt the harmony between the contracting parties. It can lead to cessation of credit facilities and loss of reputation to the debtor in the business community, and one could land up in court.

Sundry Creditors in Accounting Accounting Dictionary

August 22, 2022

Forex Trading

No Comments

acmmm

On a balance sheet or income statement, sundry income might be listed as miscellaneous income. This income must be recorded on financial statements as it affects a business’s net worth and needs to be reported to shareholders. The two main criteria attributed to ‘sundry’, or ‘miscellaneous expenses’, are that firstly the value of the expense is minimal, and secondly the expense type is rare in occurrence. Should an expense be for a greater value, be incurred on a regular basis, or not be easily classed as miscellaneous in nature, the expense must be assigned to a specific cost code within the businesses’ accounts. Whilst smaller, infrequent, expenditure incurred such as office flowers, or a one-off bank charge for instance, would fit the definition of sundry.

The income must be reported to the Internal Revenue Service along with the income generated from normal business operations. By tracking the accounts payable, you are using the credit facilities at zero interest rates and paying the due amounts later. If payments are followed systematically, you can enjoy such credit facilities fearlessly. That is why it is essential to clearly state the credit period offered or the due date of payment in your invoices.

Size, industry practice & nature of an expense plays an important role to determine whether it should be included in sundries or be given a separate ledger account. T Shoes incurs many expenses that easily fit into categories like employee wages, rent, loss on product defects, and the list goes on. Let’s say they receive a shipment of 100 shoeboxes, but two of those boxes don’t have size stickers on them. The cost incurred to buy individual stickers for those two boxes would be written off as a sundry expense. That’s because this is not a normal occurrence, the amount expensed was very low, and the expense wouldn’t fall into a standard category like wages or rent.

Phrases Containing sundry

Hence it is a liability to your business until you pay for goods or services sold to you. Besides Sundry Income, there are Sundry expenses as well, which need to be accounted for in accounting. I suspect that the term sundry was more common when bookkeeping was done manually.

The part of a company’s accounts used for recording payments made by or to companies that are not regular customers, suppliers, etc. Whenever goods or services are availed on a credit basis from your vendors, it is important to specify after a discussion on the agreed-upon timeline for payments. Prompt payments can avoid poor market relationships as well as help you maintain a healthy cash flow. Customers of companies who rarely shop with credit and have a small purchase price are sent Sundry invoices. Historically when accounting was done manually, it was tedious for accountants to add pages of all customers, even with a small number of transactions, which made bookkeeping quite awkward.

These royalties would be included in sundry accounts because the business did not directly produce or service the people or accounts that produced the income. All accounts payable are liabilities of your firm and recorded as such. Examples of sundry invoices expenses include payable delinquent interest, gifts for employees, a party for the staff, etc. Before any company can create sundry invoices for debtors, it needs to establish who the customers/suppliers/or debtors are before sending out the invoice to them.

The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. Khatabook is one such accounting app that has numerous helpful features.

Meet FreeAgent

Since sundry creditors are a liability to a firm, they will be shown on the right side of the balance sheet. Businesses use a separate category to track these transactions and they are called sundry creditor accounts or accounts payable. In those days, bookkeepers had to add a page to the company’s ledger for each customer.

Now S Enterprises is reflected under sundry creditors and is entered in the accounts payable ledger of Gunjan Traders from the date of delivery of goods till the date S Enterprises clears the amount payable to it. Creditors are individuals or companies to whom you owe money for goods or services purchased on credit. The word “Sundry” is used for items which are irregular and insignificant to be listed individually. Sundry expenses are costs incurred during business operations that are not listed separately because they are usually small, rare, and do not relate to other general expenditures. This could be a company’s payment of their own expenses or a payment received for a sundry invoice.

He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Join our mailing list to receive free bookkeeping and tax tips, news and offers from FreeAgent . The Spectator, from 1981 to 2009, and on sundry topics until 2001 for the British tabloid The Daily Mail. There are several artist managers, tour managers, and sundry booking agents on hand, just to add color and contrast to the cheerleaders.

Word History

This doesn’t fall into a standard income category and is therefore labeled as miscellaneous income. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is what is sundries in accounting a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses.

How to Record it in the Financial Statements

In the above case, Daniel Constructions is a creditor for Axis Housing, and the same is recorded in their books for 90,000 due to the credit purchase. Suppose “Daniel Constructions” sold building material worth 90,000 to “Axis Housing” on credit and Daniel Constructions agrees to receive a delayed payment in the future accounting period for the related invoice. Its purpose is to club together all irregular, infrequent, and random nature expenses that can’t be classified under any regular business expense head. The company incurs various expenses like Raw materials, Rent, Advertising Costs, etc., which are regular expenses in its day-to-day operations. In one of the recently shipped orders of 1000 customized shoes for its client XYZ International, it was found at the time of delivery that an individual logo was not pasted on 200 customized shoes.

When you buy certain goods/services from your vendors or suppliers, you must ensure that you discuss and agree on a specific timeline to make your payments. Especially when you purchase goods on credit, it is important that both parties have agreed on the payment timeline, so that there isn’t any bad blood at later stages of the transaction. Sundry creditors are considered as liabilities to a business as they are supposed to pay outstanding amount, for a specific transaction, based on the agreed timeline by both the parties. An online accounting and invoicing application, Deskera Books is designed to make your life easier.

Sundry income is often irregular and not a guaranteed source of company income over the long term. They can be related to a particular area within a business such as sundry office expenses, sundry retail expenses, etc. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless.

It is significantly useful in managing ledgers and generating business reports. Therefore, a business can be handled in a feasible manner with this app. If you purchase goods or services on credit from your vendors, you will need to track and record the transaction and amount due to your suppliers. This means a business owes them money because of credit facilities on goods and services they have availed.

Stick with your same invoice template and continue with the next invoice number in your sequence. If you’re a business owner dealing with foreign currencies, include the exchange rate on such an invoice. Also include payment terms, typically 30 days, but almost certainly less than three months. Feel free to add comments if it will increase clarity on sundry invoice costs.

A business might elect to combine several minor expense accounts and report them in aggregate in a Sundry Expenses line item. This is especially likely when a firm has a large number of line items on its income statement, and needs to condense the presentation. However, if these expenses become regular and include larger amounts, they will no longer qualify as sundry. Instead, they will need to be reported separately with a precise description in the balance sheet. Sundry expenses are shown on the expenses side of a profit and loss account .

Suppose a furniture-making company, Wood Ltd. sells furniture worth 30,000 to QRT Ltd. on credit. Financial statements are written records that convey the business activities and the financial performance of a company. Comprehensive income is the change in a company’s net assets from non-owner sources.

If a page were added for every customer, even occasional customers with small transactions, the books would become cumbersome. So, bookkeepers added one page called sundry where those customers could be recorded. The need for sundry invoices has been significantly reduced in the age of accounting software. The dynamic accounts payable head is significant to your business’s health. When the debtor who owes the firm money doesn’t pay on time, it may disrupt the harmony between the contracting parties. It can lead to cessation of credit facilities and loss of reputation to the debtor in the business community, and one could land up in court.