Category: why get payday loans

six Fund to have Do it yourself: Which one Is right for you?

Whether you are looking to boost your residence’s resale really worth or need to modify your place, there are many reasons to make home improvements. The brand new tricky region is finding out simple tips to pay for them.

With regards to resource house renovations, you have got many selections to choose from-each having its very own pros and cons. Find out about an average sorts of fund getting do it yourself, from your home guarantee-based fund in order to personal loans to dollars-away refinances.

House security financing

House security fund are probably one of the most better-understood variety of do it yourself financing due to their attractive costs and you will competitive terms.Read More »

Character Vida V1 Basic Drive Feedback: This new Champion Indian Electronic Motor scooter That weve Become Waiting around for?

The Vida V1 maybe late on people but it is proposing an alternative frame of mind towards the asking

In the event the earth’s premier dos-wheeler creator decides to make an electric scooter, you would top sit up or take find. Notice we performed, and thus did everyone. And you will, like any people, i as well had a multitude of reactions with the this new Champion Vida V1 elizabeth-scooter. Thoughts between…’OH YEAH’ to help you OH No!’. I think all of you know very well what produced united states get that history reaction, but why don’t we find out if we’re considering exactly the same thing.

Possibly You can ignore exactly how essential battery charging flexibility are. The new Hero Vida V1 ‘s the merely superior scooter in the India already that enables your three ways of charging you it.

1- Timely charging: Vida has been smart about leverage its connection to Ather and their unique quick chargers fool around with Ather’s discover requirements.And thus, not only are you able to charges the newest V1 during the Vida’s fast battery charging station, and also use the Ather’s fast charging Ather Grids. Ather currently has actually 580 fast billing issues in the more 56 urban centers. Including, in the end, this might be very theraputic for Ather customers as well.

3- Of course, if you simply cannot fees at https://paydayloansconnecticut.com/staples/ your home, say you don’t need to a loyal vehicle parking area, you can capture both the battery packs aside and you will costs him or her inside at your home.Read More »

That is why they’ve been entitled Washington’s Ideal Full Credit Relationship in Arizona Customers Checkbook 19 age running

BECU (earlier known as Associated Credit Partnership) depends inside Seattle, Arizona, and are also the largest borrowing commitment in the region that have over 145,000 users (since 2013). Their mission was to create a far greater lives for everyone, communities and you will groups it serve.

BECU varying-speed funds

A changeable-speed financial, otherwise Arm, is a kind of capital where in actuality the interest can also be change occasionally.Read More »

During the Oklahoma, nearly 15,000 home loans have been fully accepted

October 28, 2024

why get payday loans

No Comments

acmmm

Restriction mortgage limitations are different by the state

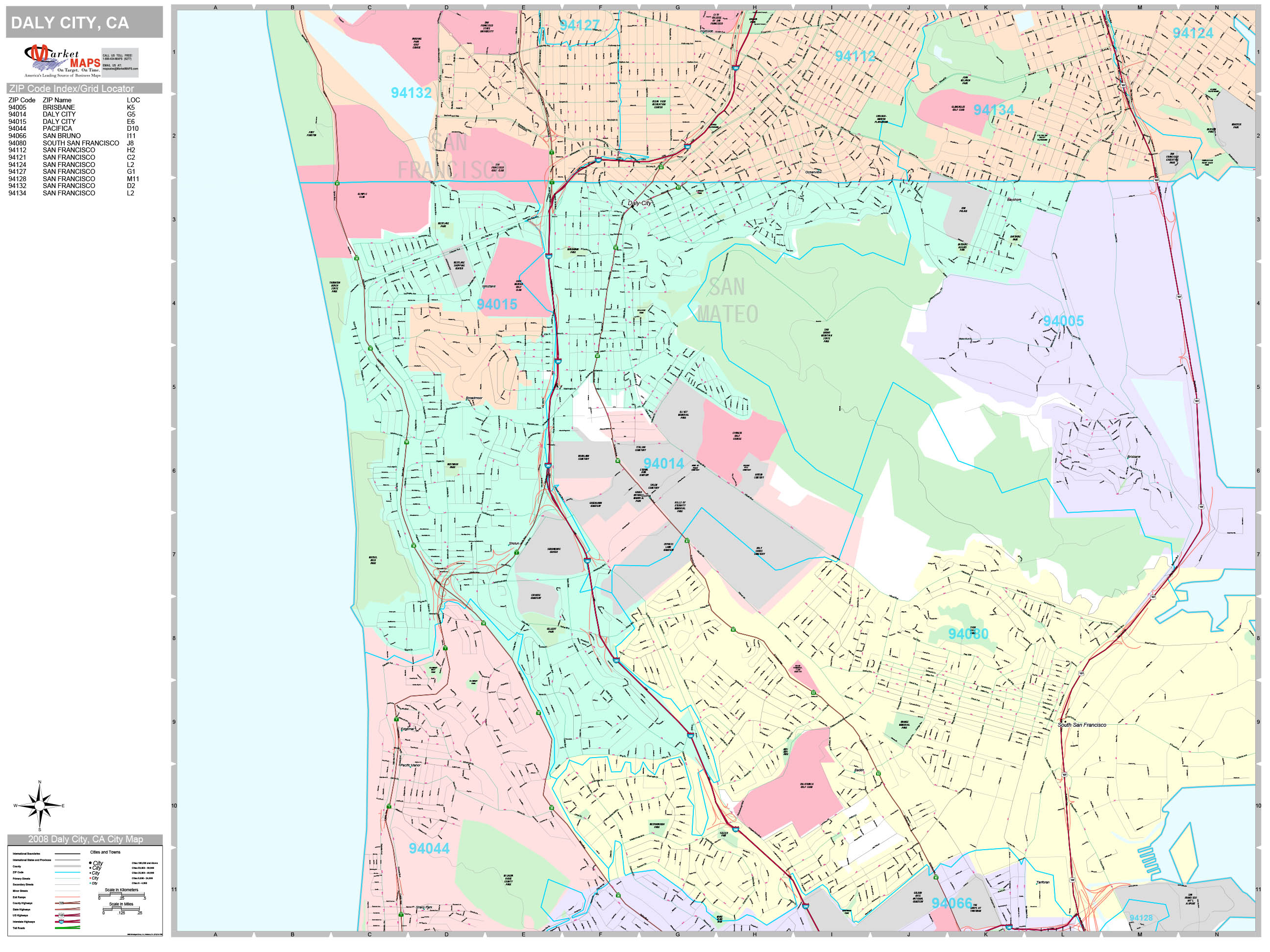

A chart of the United states showing Point 184 mortgage approvals from inside the each condition by , the newest map the brand new Construction and Metropolitan Advancement enjoys. Housing And you may Urban Development

Restriction loan restrictions are different from the condition

Restrict financing constraints will vary because of the county

Oronoque loans

TAHLEQUAH, Okla. — Of many Native Americans can get be eligible for home loans through a You.S. Casing and you will Metropolitan Advancement system that’s resided for more than two many years. The brand new Area 184 Indian Mortgage Guarantee Program provides flexible underwriting, is not credit-get centered which will be Indigenous-particular.

Congress situated they when you look at the 1992 so you’re able to assists homeownership from inside the Indian Nation, and lots of of their positives include low down payments without private mortgage insurance coverage.

“I just imagine its a beneficial program, and i purchased my personal domestic doing this,” Angi Hayes, a loan maker getting very first Tribal Credit during the Tahlequah, told you. “I just imagine it is so great, (a) system more people should know and obviously new people should become aware of.”

Read More »