Category: where can i use cash advance

Just what Were the best Mortgage Pricing at this moment?

The newest Impact of your own Thread Market

The connection market, and especially the brand new 10-season Treasury produce, also influences home loan costs. Usually, thread and you can rates of interest often move around in the opposite guidelines. Because of this expands from inside the industry pricing usually correlate that have thread rates falling, and you can vice versa.

Bank Factors

Beyond additional products which can be beyond a good homebuyer’s manage, private items in addition to affect the rates they’re going to find whenever using to possess a home loan. The second products are at the top of head from loan providers every time you make an application for a special mortgage otherwise refinance loan.

- Credit history: People who have most useful credit can qualify for down financial costs complete with many different financing products.

- Advance payment: Huge off money may help buyers safer less financial rate.

- Interest Types of: The possibility ranging from a predetermined interest and you may a varying one may affect the rate you only pay.

- Amount borrowed: The cost of a home and loan amount can also play a role in financial rates.

- Mortgage Term: Shorter-title mortgage brokers often include straight down rates than fund having offered repayment words.

- Mortgage Particular: The sort of financial you get make a difference to your own home loan rate, if or not you opt for a traditional financial, Government Property Management (FHA) mortgage, U.S. Agencies regarding Agriculture (USDA) home loan, otherwise Virtual assistant loan.

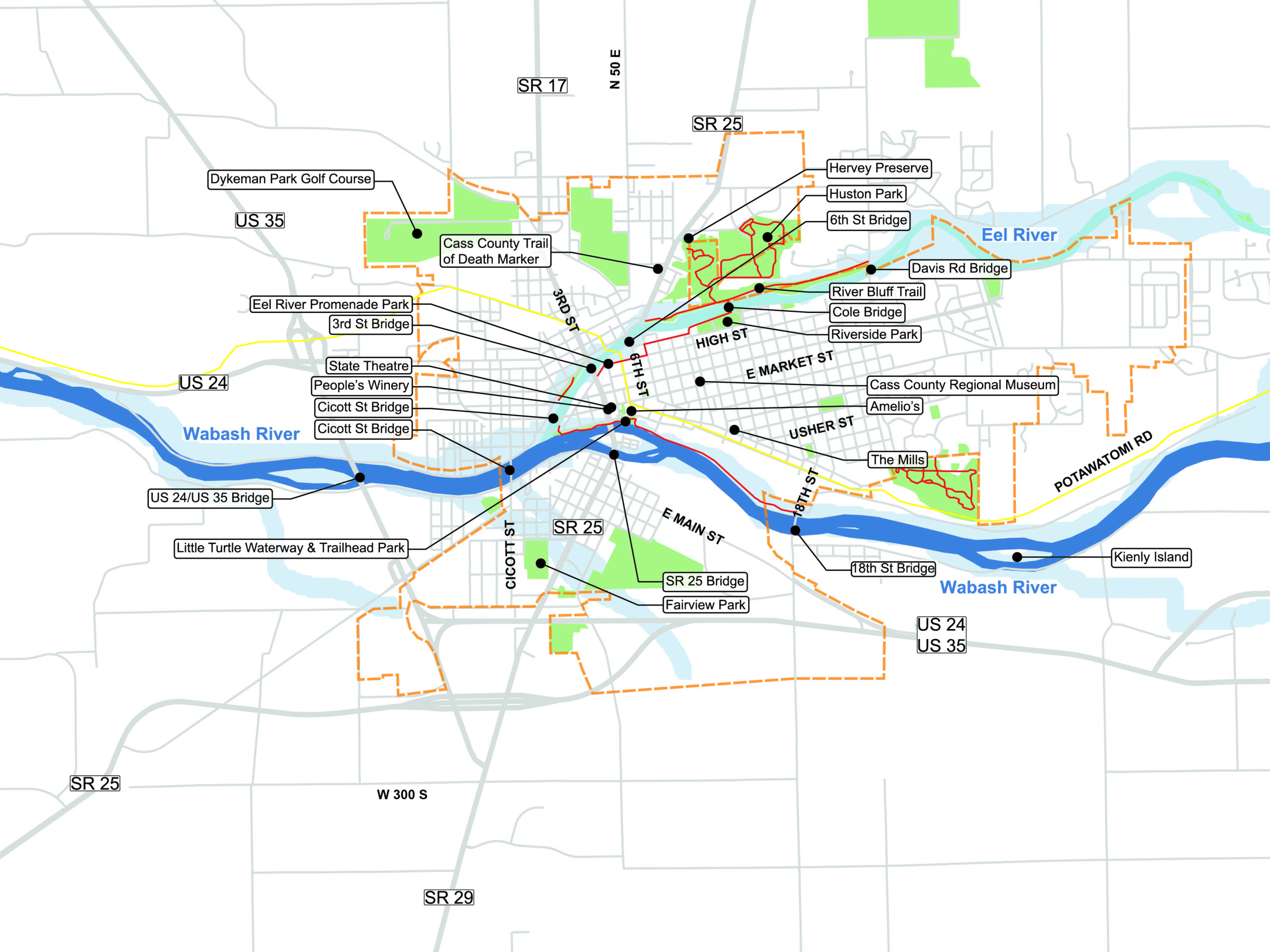

- Location: Certain areas of the nation enjoys highest or lower home loan rates overall.

Based on Freddie Mac computer, home loan pricing peaked into the October off 1981 in the event that mediocre speed to the 31-12 months, fixed-speed mortgage loans try %.

How many times In the event that you Contrast Financial Cost?

Evaluate home loan pricing should you decide decide to purchase or refinance a property.Read More »

The Advancement regarding Poor credit Financial Software

All you have to Know about Home loan Approvals and Bad credit

One another Fannie mae and Freddie Mac have software packages which they fool around with which can instantly approve of numerous funds depending credit history, complete costs, and income. This really is named automated underwriting.

For folks who presently has bad credit score, you will possibly not end up being an applicant to have automatic underwriting. Nevertheless the lender nevertheless may be able to approve your via guide underwriting. It makes sense to locate a pre-recognition written down prior to one duties. Understand how to get a pre-acceptance to possess a FHA home loan today.

Particular mortgage organizations for bad credit have a tendency to still allow loan software are accepted when you yourself have a minimal credit rating. you could need to has something else to compensate to possess it. http://elitecashadvance.com/loans/1-hour-direct-deposit-loans-in-minutes Eg, for those who have a good 590 credit rating, you really have difficulties being qualified for most less than perfect credit household mortgage loans.

But when you can lay more income down otherwise enjoys multiple months of cash supplies, you may be able to find accepted.Read More »

What takes place basically can’t pay back my personal connecting loan?

Bridging Financing FAQ

While struggling to pay up at the end of the word, really lenders have a tendency to consider extending the fresh new arrangement whenever you be sure that your particular leave method might possibly be having to pay soon. Although not, they might strike your with hefty costs and prices for broadening the expression.

Whether or not the bank begins repossession legal proceeding whenever a borrower are unable to settle right up is at its discretion.Read More »

Ways to get a mortgage With Below 12 months Work

October 27, 2024

where can i use cash advance

No Comments

acmmm

Applying for a mortgage can seem to be out-of-reach if you find yourself starting out or pivoting work. Conventional pointers says you desire 2 years from a career records when you look at the an identical condition to try to get a mortgage. However, due to the fact mediocre American employee vary work twelve times within community, there are many someone each time which won’t qualify having a home loan.

However, all the isnt missing. You might still have the ability to qualify for a home loan which have less than 1 year from employment whenever you are better-wishing and will show enough economic fuel. It will help for decades within the a career to track down home financing, but it’s not always required, once the an underwriter will at your over economic image, together with training. Towards the ten tips below, you are able to assistance their circumstances and then have acceptance.

The work record you ought to get a home is much more nuanced than simply a single count. While most old-fashioned mortgage loans want 2 years off work history, that’s not a necessity in virtually any circumstances.

Your ple, you could potentially have shown plus points like degree to suit your most recent occupation away from works otherwise a page detailing a current occupations alter. Your credit rating, debt-to-income proportion, advance payment and you can deals may absolutely impression qualifying getting a good mortgage.

Fundamentally, a credit rating significantly more than 740 is considered an effective and certainly will let secure home financing because tells loan providers that there surely is a reduced risk possible standard into loan.Read More »